UGBS Hosts Launch of the Financial Literacy Educators Association Ghana (FLEAG)

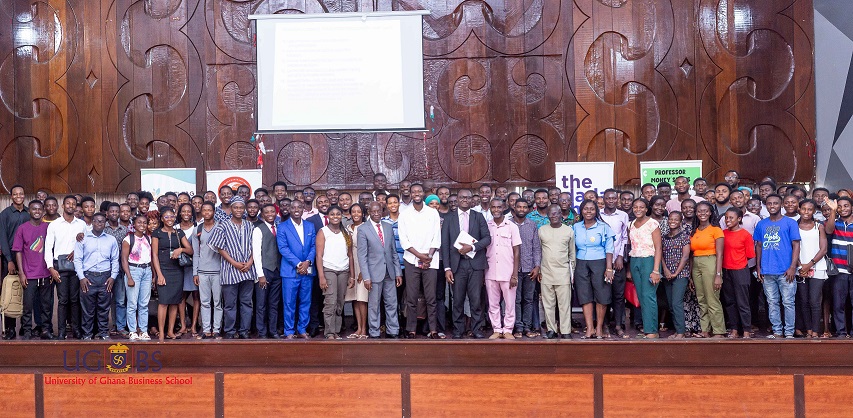

The University of Ghana Business School (UGBS) hosted the official launch of the Financial Literacy Educators Association Ghana (FLEAG) on 18th December 2024 at the R. S. Amegashie Auditorium. The event brought together prominent stakeholders, financial experts, educators, students, advocates for financial literacy, and UGBS alumni to champion the cause of improving financial literacy across Ghana.

Dr. Benjamin Amoah, President of FLEAG and Senior Lecturer at UGBS explained that “the essence of FLEAG is to provide quality education and embrace financial literacy among young adults and the nation. We aim to encourage finance, banking, and investment students to excel in the workplace.” According to him, financial literacy is part of human capital investment. A financially literate citizenry is more likely to save, invest, and borrow responsibly contributing to national development. People with low financial literacy are more prone to debt issues, while financially literate individuals are better prepared for retirement and capable of assessing government finances critically. He advocated for a unified platform to promote financial literacy across Ghana.

Dr. Amoah’s inaugural lecture focused on the importance of financial literacy, which he described as the combination of awareness, knowledge, skills, attitudes, and behaviours necessary to make sound financial decisions and achieve individual economic well-being. He described financial illiteracy as a global problem and outlined FLEAG's commitment to curbing it. He presented Ghana's current state of financial literacy with the five-year National Financial Literacy Strategy (2021–2025). He added that the Financial Literacy Education Project (FLEP) indicated an increased financial inclusion from 58% in 2015 to 85% by 2023, as reported by the Ministry of Finance. However, he also pointed out gaps in financial literacy content within the national educational curriculum.

Mr. Evans Bediako Osie, National Insurance Commission (NIC) and a UGBS alumnus discussed NIC's public engagement efforts, including free training schemes for insurance agents, insurance clinics for small businesses, and public education campaigns. He noted that despite challenges like fraud, the commission remains committed to enlightening the public on insurance and financial literacy. “These efforts are crucial to creating a financially informed society.” He said.

Ms. Patience Arko Bohan, Ministry of Finance also spoke about the Ministry’s partnership with the World Bank and regulatory bodies like the Bank of Ghana and NIC to develop a comprehensive National Education Foundation Campaign. “Our focus is on promoting savings, insurance, and investments across Ghana through a multifaceted approach that ensures collaboration and enhances financial inclusion.” She explained.

Dr. Adu Anane Antwi, former Director-General of the Securities and Exchange Commission (SEC) and UGBS alumnus, delivered the keynote address. He emphasised on the role of financial literacy in investor protection and the growth of financial markets. He noted that well-informed and educated investors are key drivers of financial market growth. A financially literate population is better protected from risks and more likely to make sound investment decisions. He also encouraged students to be prudent with loans and advocated for simplified communication of financial terms to laypeople as part of Ghana’s financial literacy strategy. He urged policymakers and educators to prioritise financial education, giving participants a history of financial literacy in Ghana to date.

Mr. Nii Amoh Otoo, National Pensions Regulatory Authority (NPRA) urged students to prioritise retirement planning early, while Mr. Kim, National Commission on Culture discussed plans to target youth through innovative investor education materials, including animations, printed material and other resources for individuals with disabilities.

Dr. Adu Anane Antwi further declared the official launch of FLEAG. Mr Joshua Mensah of FLEAG explained the benefits of joining the association, emphasising its mission to provide high-quality financial literacy support to individuals and students. Delivering the closing remarks, Mr Benjamin N. Otchere of FLEAG stated: “This marks the beginning of a serious movement to broaden financial literacy in Ghana. Together, we can build a more financially literate nation.”

The event concluded with networking sessions and discussions on strategic partnerships to advance financial literacy nationwide. Representatives from the Chartered Institute of Bankers, Young Investors Network, Dada Foundation Ghana, and other advocacy groups were in attendance, signalling widespread support for the initiative.

About FLEAG

FLEAG is a non-profit organisation dedicated to promoting financial education and awareness in Ghana. Its mission is to provide impactful and relevant financial literacy content to educators and thought leaders in Ghana and beyond. The organisation envisions to become a globally respected channel for educators and advocates driving positive changes in financial literacy and personal financial management to support the financial services industry.